Appendix 9 - SET Clear Motivations & Technically Complex

Quoting from SET Secure Electronic Transaction

Specification Book 1: Business Description it provides a clear description

of the role of an Internet payment mechanism

"

The development of electronic commerce is at a critical juncture.

![]() †† Buyerís

demand for secure access to electronic shopping and other services is very

high.

†† Buyerís

demand for secure access to electronic shopping and other services is very

high.

![]() †† Sellers

want simple, cost-effective methods for conducting electronic transactions.

†† Sellers

want simple, cost-effective methods for conducting electronic transactions.

![]() †† Financial

institutions want a level playing field for software suppliers to ensure

quality products at competitive prices.

†† Financial

institutions want a level playing field for software suppliers to ensure

quality products at competitive prices.

![]() †† Payment

card brands must be able to differentiate electronic commerce transactions

without significant impact to the existing infrastructure.

†† Payment

card brands must be able to differentiate electronic commerce transactions

without significant impact to the existing infrastructure.

![]() †† The

next step toward achieving secure, cost-effective, on-line transactions to

satisfy market demand is the development of a single, open industry

specification."

†† The

next step toward achieving secure, cost-effective, on-line transactions to

satisfy market demand is the development of a single, open industry

specification."

Unicate is in full agreement with these principles but is

concerned that the expense of SET will in fact hold back the forecasted growth

of business to consumer-based eCommerce.†

Quoting from an article published by the Shroud Partnership stated in

1997, 1998:

"All

the technical and organizational elements seemed to be in place, but from the

news that has been emerging about the various pilot schemes it would seem that

all is not well.† Many of the problems

seem to be caused by the complexity of the SET process."

They go on to say:

"In

an effort to ensure that consumers are satisfied that their credit card

transactions are safe it seems that the whole process has been

over-engineered.† The huge collective

marketing clout of the SET members will be needed to overcome consumer

resistance to the complexity of the transaction and the reluctance of merchants

to invest in the necessary IT services and equipment to enable it to be

used."

SET embeds digital certificates and private keys in the

buyer's insecure PC.† This creates

obstacles to the buyer's ability to shop using a diverse array of devices such as

those found at home, in the office, in a cyber cafe or at a friendís

house.† The owners of SETco and its

advocates see the solution to this need for buyer mobility as the integration

of smart cards "EMV" with SET.†

Yet, if the United States is a sample of how quickly smart card adoption

will occur, it will be years before buyers have the freedom they demand.

Reviewing the status of SET implementations and visiting

shops on the Internet, it is clear that there is little or no progress in SET

becoming a globally accepted standard.†

Many banks have explored the idea of implementing SET but with the

exception of limited trials no one has begun a full scale roll-out.† Simultaneously, when talking with vendors of

SET software interoperability between different vendor implementations is a

major concern.† Plans exist to alleviate

this problem by the introduction of a cumbersome certification process and as

of July 1999 only one vendor can successful state that it has a compliant

implementation.

In parallel, there is a ground swell of negative opinion and

publicity surrounding SET and several major telecommunications vendors are

saying they will not implement SET because of its inherent technical complexity

and their belief that this complexity was intentional.†

Numerous critics of SET argue that it is overly complicated

and demands excessive computation power.†

Numerous merchants have expressed concern at the cost of implementing

SET and cannot countenance the computational burden resulting from SETís public

key implementation.† Everyone has

expressed frustration with the complexity of the SET protocol.† Systems integrators, frustrated by the fact

they cannot guarantee their clients that the SET implementations will be

interoperable, are antagonistic towards SET.†

Many wonder why SET bears no resemblance to ISO 8583, the familiar

payment architecture that is employed to process payment transactions.† Finally, there are industry experts that

ponder if SET is yet another attempt by the payment associations to guarantee

themselves revenue.

With SET's slow move from pilot into commercial deployment,

many merchants have adopted SSL.† They

embraced SSL since it is capable of securing (within the limits of the law) the

content of messages traveling between two points on the Internet.† SSL is also capable of providing and

performing PKi based authentication services.†

SSL does not secure sensitive information held inside Personal Computers

and Merchant Servers.† These computers

are the obvious and profitable weak point for hackers to attack.† All this being said SSL does not meet the

security requirements of the financial institutions.† Moreover, with SET being the banking systems agreed approach this

complicates using SSL as a means of authentication.

Many are looking to alternate solutions that in many cases

resemble the solution Unicate is proposing but they forget two very important

factors.† First, they require the

existence of a complex public key architecture, which the banks must agree to

support.† Second, they do not have a

clear solution to the issue of mobility without requiring the introduction of

expensive EMV like smart cards.

To complicate matters, there is work underway to merge SET

and EMV.† Many believe this merging will

require that one or both specification will have to relinquish its objective of

backward compatibility.† -† Net result many existing implementations

will become obsolete.†

Furthermore, if EMV is to dictate the technical

specifications of smart card readers associated with personal computers and other

Internet access devices the cost to the buyer will be staggering.†

Not to put to fine a point on it, Microsoft has recently

announced its Windows for Smart Card operating system.† It is now discussing with hardware vendors

the integration of inexpensive smart card readers into every Personal

Computer.† This begs an interesting

question; will this Microsoft Smart Card Compatible reader also be EMV

compliant?† -† At this time, the answer is NO!

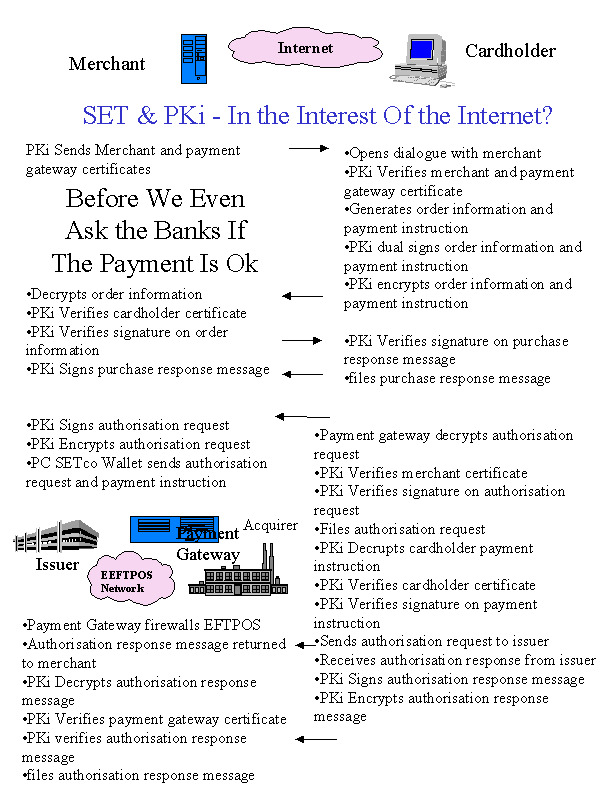

SET

PKi flow chart as explained at a conference by Racal Security Systems